GEEK.SG

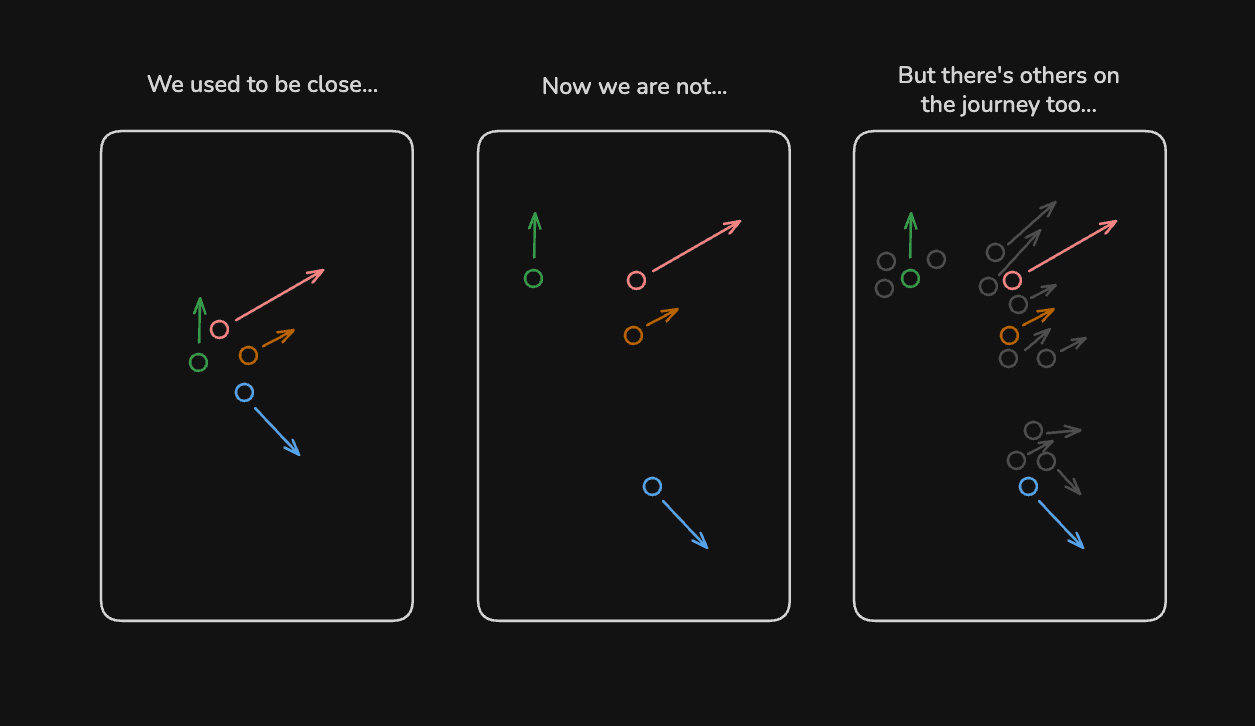

Why Friends Drift Apart (and Why You Need a New Kind of Peer Group)

05 February 2026

We blame "busyness" for losing touch, but the truth is deeper. We drift when we no longer share the same problems. Here's a new mental model for high-performance networking that replaces the "awkward fade-out".

Stop building! Validate your idea in 8 hours.

08 December 2025

Are you 'building' to avoid validation? Discover how to test if your startup idea is actually valuable in just 8 hours.

The Two-Call Rule

24 November 2025

I have a rule for new collaborations with founders or clients: two calls. That’s it. If a decision hasn’t been made by the end of the second call, the idea or lead moves to a low-priority list.

So... I applied to Iterative.

21 November 2025

I've just sent in my application for Iterative's accelerator. Thought that I'll make my application public so here goes. Below is my application in full.

Nothing is Beneath Me

19 November 2025

I once had to pick poo out of my robot vacuum. It was because it was the highest leverage thing I could do then. There’s nothing beneath me. The only reason things get done by me, or not, is leverage. And this is how I hire.

What are you optimizing for?

18 November 2025

The code I write today is terrible. My 25-year-old self, who wrote code for monolithic government systems, would be appalled. He would probably fire me.