I've recently come across a new program by Block71, named SuperCharge, shared by some influencers on LinkedIn. On first glance, it looked interesting because it’s focused on marketing spend, which is a crucial area for startups. However, spending more time on the website led to alarm bells going off in my head as I noticed various red flags as a startup founder.

This made me ponder if this issue is reflective of a greater problem plaguing the startup scene in Singapore. Let’s explore these barriers, the broader context of government involvement, and how we can refine our approach to nurturing a vibrant and high-growth startup environment in Singapore.

Examining SuperCharge’s Offerings

Firstly, the 50K marketing allocation in the SuperCharge program is an in-kind investment. While attractive on the surface, this offer lacks transparency. There’s no clear percentage of equity being ceded or any valuation cap mentioned, raising red flags akin to a bad SAFE (Simple Agreement for Future Equity) deal or convertible note. Additionally, the eligibility criteria—a Singapore-registered startup with two founders and a minimum of 50K in annual recurring revenue (ARR)—further complicate things.

Here's why:

Targeting Misalignment: Startups that have achieved 50K in ARR are likely on a growth trajectory where they can attract much better deals from VCs. They don’t need restrictive strings attached to 50K in marketing spend.

Unappealing for High-Growth Startups: If a startup can grow at consistently week-on-week and achieve 50K ARR in the first year or two, such startups can command better terms and equity arrangements elsewhere. I run a back-of-napkin calculation below to showcase this.

Better Suit for Agencies: This deal may attract agencies or service businesses instead and finding the free marketing dollars useful. However, these businesses aren't likely to return high growth or substantial exits, making the investment less lucrative for the accelerator.

The Underlying Problem: Startup Culture in Singapore

SuperCharge's structure reflects a larger issue in the regional ecosystem—optimizing for efficiency and downside risk rather than focusing on unbounded upside potential.

Historical Context & ConstraintsSingapore’s grant landscape is rife with examples of well-intentioned but poorly executed efforts. Recall the PSG grant aimed at enhancing productivity, which inadvertently allowed misuse and fostered a culture of grant-churning rather than fostering genuine innovation. The same mindset appears in programs like SuperCharge, aiming to prevent misuse but missing the essence of high-growth startup dynamics.

Why do these issues persist?

Lack of Founder Perspective: Managers and program directors typically aren’t founders themselves. They might lack an understanding of founder-friendly terms or the nuances of evaluating a startup's potential.

Overemphasis on Process Efficiency: Instead of betting on potential exponential returns, current structures are designed to avoid failure, leading to local minima problems.

Optimization Problem: Constraints Leading to Local Minima

Programs like SuperCharge illustrate a fundamental optimization problem where restrictive criteria and constraints force outcomes into a local minima—suboptimal performance confined by the very rules meant to safeguard success. Instead of fostering an environment for exponential growth, these constraints deter high-potential startups, attracting only those businesses that minimally meet the criteria, often leading to inferior returns.

Downward Spiral DynamicsRestrictive Criteria: Starting with stringent requirements, the program weeds out potential high-growth startups.

Deterrence of Good Founders: High-caliber founders, who can opt for better terms elsewhere, avoid such programs.

Poor Applicant Pool: The remaining applicants are often slower-growing or non-scalable businesses that manage to pass the criteria.

Bad Return on Fund: Because the accepted businesses don’t generate substantial returns, the program’s outcomes are lackluster.

Increasing Restrictiveness: In an attempt to ensure better applicants, programs introduce even more restrictive criteria, perpetuating the cycle.

Contrast this with programs like Y Combinator (YC), which operates under a different philosophy:

Less Restrictive Application Criteria: YC's application process is relatively straightforward, allowing a wide array of startups to apply without overly burdensome initial criteria.

Stringent Screening Process: Post-application, YC employs a rigorous screening process to select startups with the highest potential.

Positive Flywheel Effect: Once accepted, these top-tier startups receive comprehensive support, leading to success stories that encourage other great founders to apply. This creates a positive recommendation loop, enhancing the quality of applicants continually.

Insights from a Startup Perspective

Today's startup environment demands an understanding of the unique challenges and growth trajectories that define high-growth ventures. Speaking with other founders, I’ve noted a recurring theme: while the intentions behind programs are commendable, they often fall short in execution due to a fundamental misalignment with the startup ethos.

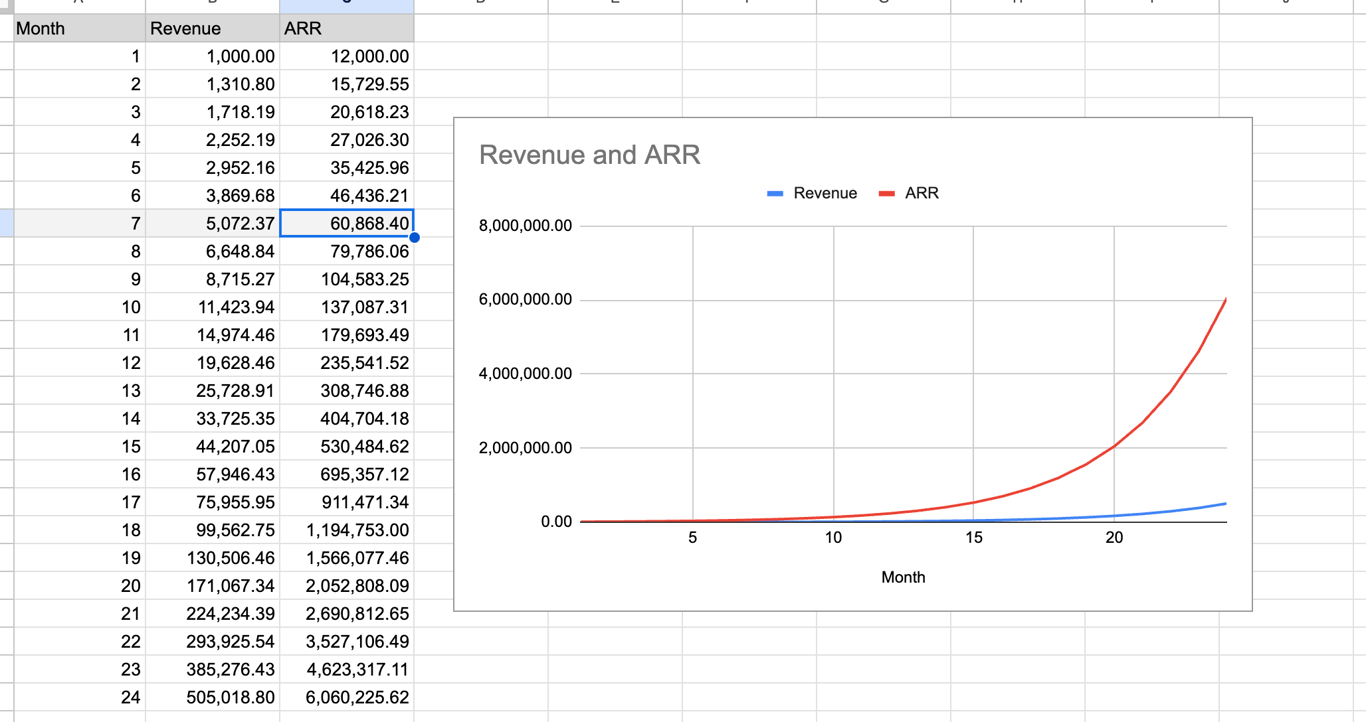

A Case Study In NumbersTo illustrate the disparity between high-growth startups and the criteria set by SuperCharge, I’ve run a simulation showing the growth of a hypothetical startup. Let’s assume a startup with an initial Monthly Recurring Revenue (MRR) of 1K and a growth rate of 7 percent week-on-week.

By month five, this startup would have achieved an ARR of ~35k, still not meeting the SuperCharge eligibility criteria of 50K ARR. It’s only by month seven, after crossing 60k in ARR, that the startup would qualify. By this time, the startup is on a path to substantial growth, reaching over 6M ARR by the end of year two. Clearly, the founder that has maintained a 7% WoW growth for 7 full months will not find the additional 50K useful or even making sense!

The Broader Landscape: Government’s Role and Opportunities

Reflecting on the history of grants and government involvement in Singapore's startup ecosystem, it’s essential to understand that the issues aren't just isolated to SuperCharge. Programs often operate with an inherent risk-averse mentality, aimed at preventing misuse rather than fostering potential.

The Impact of Risk AversionGrants designed to minimize risk, while well-meaning, can inadvertently stifle innovation. The emphasis on downside protection neglects the core characteristic of startups: the potential for exponential growth. This misalignment manifests in eligibility criteria, application processes, and disbursement mechanisms that deter high-growth startups.

Instead of fostering a vibrant startup culture, these constraints lead to an environment where service-oriented businesses that align with linear growth models become the primary beneficiaries.

Building Program Success: Insights and Recommendations

1. Differentiate Startups from Agencies:

Learn to distinguish between a traditional service business focused on year-on-year incremental growth and a startup poised for exponential scaling. Paul Graham’s essay “Startups = Growth” can offer invaluable insights into identifying true high-growth potential startups.

2. Think in Bets:

Shift the investment mindset towards embracing power laws and asymmetric returns. Recognize that most investments will fail, but the success of a few can immensely outweigh the losses. This approach is akin to successful VCs who invest based on Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM).

3. Consult and Hire Experienced Founders:

Engage founders who have scaled businesses to provide mentorship, guidance on structuring founder-friendly terms, and insight into the competitive VC landscape. Founders can help in effectively distinguishing genuine high-growth ventures from those merely seeking grants.

Final Thoughts and Forward Look

In conclusion, while the Block71 SuperCharge program stems from good intentions, it can fundamentally fail to attract high-quality founders due to its restrictive and non-transparent criteria.

This issue isn't isolated to one program; it's a symptom of a broader problem within Singapore's startup ecosystem where risk aversion and process efficiency often overshadow innovation and exponential growth. It's crucial to recognize that startups are not regular businesses; their unique needs and explosive potential require tailored support and understanding.

To truly nurture a thriving startup environment, we must cultivate founder-friendly policies, consult experienced entrepreneurs, and embrace calculated risks. Only then can we unlock the full potential of Singapore’s startup ecosystem and create a robust culture of innovation and growth. Together, with a renewed focus on founder perspectives and thoughtful program design, we can supercharge our nation's entrepreneurial spirit and drive remarkable success.

Additional Read

SAFE vs Convertible note - Understand the standard terms for investment. The most common in early stage startup is the SAFE or Convertible note.

Startup = growth - Understand what makes a startup a startup.

How Much Should You Allocate to Angel Investing? A Practical Guide - How to think about making bets, especially with startups. Written for angel investors but great for program managers too.