Angel investing has become an increasingly popular activity, especially with the rise of startup culture and success stories of people making life-changing returns. You've probably seen posts on social media or heard from friends about the allure of investing in early-stage companies and potentially hitting it big when one of them exits successfully.

The idea of being an angel investor can be exciting – getting in on the ground floor of innovative startups, rubbing shoulders with entrepreneurs and venture capitalists, and maybe even turning a modest investment into a windfall. Stories of people investing just a few thousand dollars and walking away with millions after an exit can fuel dreams of striking it rich.

However, as with any investment opportunity, angel investing comes with its own set of risks and considerations. Before diving in, it's crucial to understand what you're getting into and whether it aligns with your investment goals, risk tolerance, and financial situation.

Deciding if Angel Investing is Right for You

Illiquid Investments

One of the key characteristics of angel investments is their illiquidity. Unlike publicly traded stocks or bonds, you can't easily sell your stake in a startup whenever you want. Once you've made an investment, you'll likely have to hold it for several years, potentially even a decade or more, before there's an opportunity for an exit (if at all).

This illiquidity means that the capital you invest in startups should be money you're comfortable not having access to for an extended period. If you foresee needing those funds within the next 5-10 years for major expenses like buying a house, funding your child's education, or retirement, angel investing may not be suitable.

Prepare for Total Losses

Angel investing is a high-risk, high-reward endeavor. According to a study by the Angel Resource Institute, around 30% of angel investments result in a total loss, meaning you lose your entire investment.

This statistic highlights the importance of having a mindset where you treat each angel investment as if the money is gone the moment you write the check. While it's exciting to dream about the potential upside, you should be prepared to lose your entire investment without it significantly impacting your overall financial situation.

Power Law Distribution of Returns

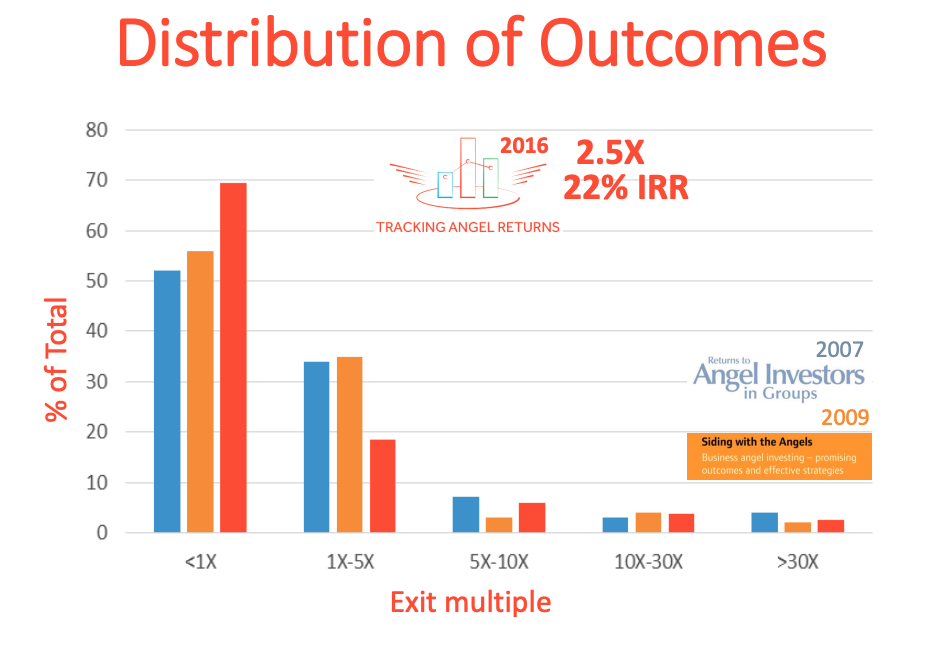

In the paper Returns to Angel Investors in Groups, it was found that the average multiple on invested capital (MOIC) for angel investments is 2.5x, with an internal rate of return (IRR) of around 22% and a holding period of 4.5 years. However, these are just averages, and the reality is that returns in angel investing follow a power law distribution.

This means that a small percentage of investments (around 10%) generate the majority (85%) of the overall returns, while most investments either fail or generate only modest returns. The median investment is actually a loss, while the mean is that 2.5x multiple.

Understanding this power law dynamic is crucial because it means you need to be prepared for a portfolio where most of your investments may not generate significant returns, but a few big winners can potentially make up for the losses and then some.

If you're someone who struggles with the idea of sustaining losses across a majority of your investments, or if you have a low risk tolerance, angel investing may not be the best fit for you.

Allocating Your Investment Portfolio

Once you've decided that angel investing aligns with your risk tolerance and investment goals, the next step is to determine how much of your overall portfolio you should allocate to this asset class.

The common recommendation from experts is to limit your angel investment allocation to 5-10% of your total investment portfolio. This percentage may seem small, but it's a prudent approach given the high-risk nature of angel investing.

For example, if your total investment portfolio is worth $1 million and you want 5% in early-stage investment, then you will be allocating $50,000 for this purpose.

It's important to note that this is a general guideline, and the appropriate allocation may vary based on your specific circumstances, such as your net worth, investment experience, and risk appetite.

If you have a higher net worth, say $10 million or more, you may be able to allocate a higher percentage (e.g., 10-15%) to angel investments without significantly increasing your overall portfolio risk.

Another factor to consider is how you want to deploy your allocated capital. Do you want to invest the entire amount in a single year, or would you prefer to spread it out over several years?

Spreading out your investments can help you diversify across different vintage years, which is important because startup valuations and market conditions can vary significantly from one year to the next.

For example, let's say you've decided to allocate $50,000 to angel investments, you could choose to:

invest $50,000 in a single year, or

invest $10,000 over 5 years

The approach you choose will depend on your investment strategy, deal flow, and personal preferences.

Additionally, it's essential to consider your ongoing income and portfolio growth when determining your angel investment allocation. As your net worth and investment portfolio grow over time, you may be able to allocate more capital to angel investments in the future.

Building a Diversified Angel Portfolio

Diversify by increasing number of deals

One of the keys to successful angel investing is proper diversification. Given the power law distribution of returns we discussed earlier, where a small percentage of investments drive the majority of the gains, it's essential to spread your capital across a sufficient number of deals to increase your chances of capturing those big winners.

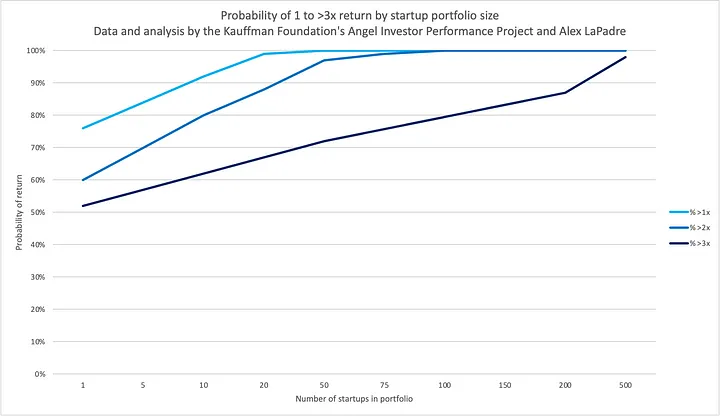

According to research by Robert Wiltbank in his 2007 paper "Returns to Angel Investors in Groups," investing in just 2-3 startups carries a high risk of catastrophic losses. To increase the odds of achieving the average 2.5x cash-on-cash return in this asset class, experts recommend a portfolio of at least 10 investments.

However, for a more robust portfolio, Wiltbank and other experts believe that 30 to 50 investments over a five-year period is a more appropriate target. This level of diversification can provide a 99% chance of breaking even and a 67% chance of achieving a greater than 3x return.

At the extreme end, investing in 500 different companies can create near certainty of breaking even and a 96% chance of a 3x return or better. Of course, for most individual angel investors, investing in 500 companies may not be feasible or practical.

Diversify across different years

In addition to diversifying across a sufficient number of deals, it's also important to diversify by vintage year. Vintage year refers to the year in which you make your investments. Market conditions, startup valuations, and investor sentiment can vary significantly from one year to the next, impacting the potential returns of your investments.

As highlighted in a report by CAIS Group, allocating to a single vintage year, even if it's a top-performing fund, can lead to a wide range of outcomes. Diversifying across multiple vintage years can help mitigate this risk.

To illustrate how you might approach building a diversified angel portfolio, let's consider an example:

Let's say you've decided to allocate $50,000 per year from your overall portfolio. Based on the recommendations we've discussed, you might want to:

invest in 10 different startups each year, with an

average check size of $5,000 per investment

Over a five-year period, this approach would result in a portfolio of 50 investments, diversified across multiple vintage years and sectors. While some of these investments may fail or generate modest returns, the goal is to capture a few big winners that can drive outsized returns for your overall portfolio.

Of course, this is just one example, and the specific numbers and approach will vary based on your individual circumstances and preferences. The key takeaway is the importance of diversification – both in terms of the number of investments and the vintage years – to increase your chances of success in the high-risk, high-reward world of angel investing.

Selecting Startups and Deploying Capital

Now that we've covered portfolio allocation and diversification strategies, the next step is actually selecting the startups you want to invest in and deploying your capital.

While diversification is crucial, it's also important to be selective and diligent in your investment decisions. Not every startup opportunity is worth pursuing, and conducting thorough due diligence is essential to mitigate risks and increase your chances of success.

One effective way to get started is by joining an angel investor syndicate or network. These groups provide access to curated deal flow, mentorship from experienced investors, and frameworks for evaluating startup opportunities.

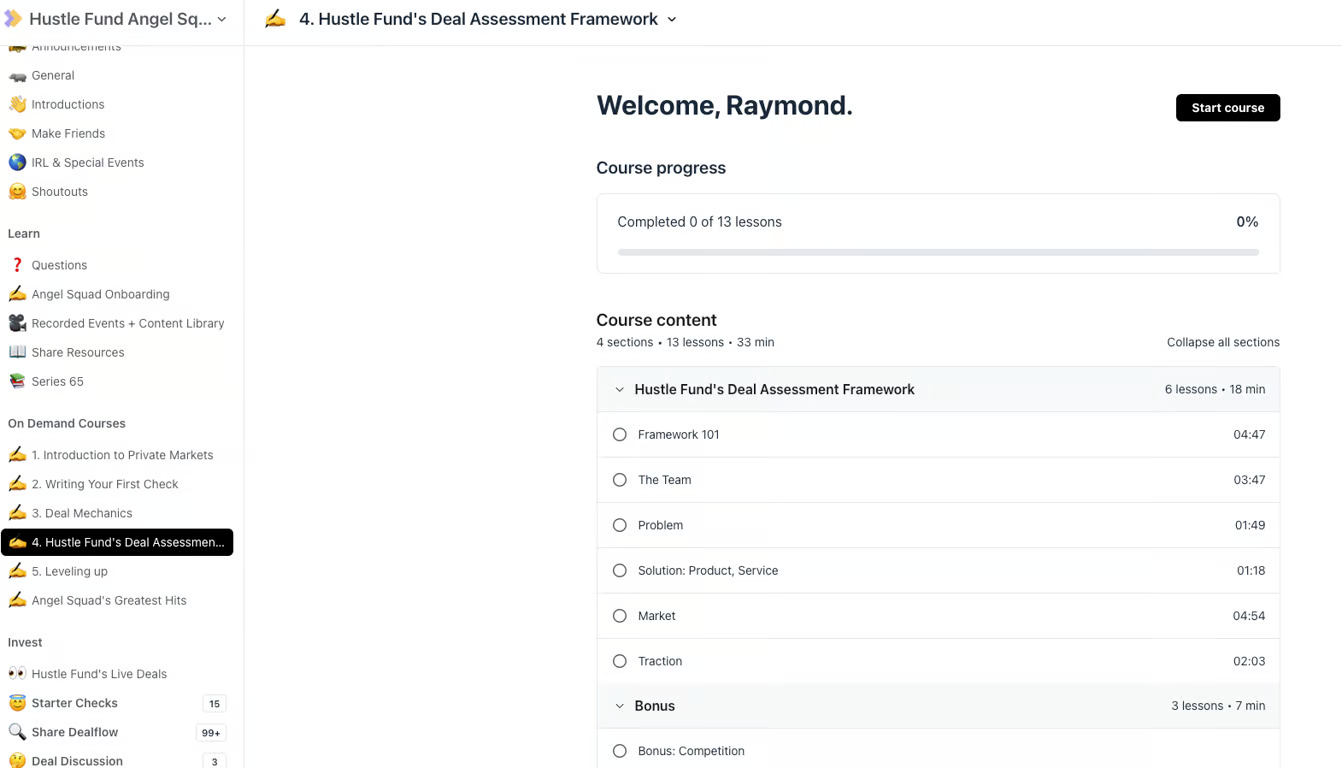

For example, you could consider joining a syndicate like Hustle Fund's Angel Squad. I've reviewed my experience with Angel Squad in this other blog post. By being part of a syndicate, you can leverage the collective expertise and resources of the group, which can be particularly valuable for new angel investors.

Within these syndicates, you'll typically have access to detailed information about each startup, including pitch decks, financial projections, and founder backgrounds. This information can help you conduct your due diligence and make more informed investment decisions.

Hustle Fund's Deal Assessment Framework available on AngelSquad's community platform

Additionally, many syndicates have established frameworks or criteria for evaluating deals, which can be invaluable for new investors who are still developing their own investment theses and decision-making processes.

As you gain more experience and confidence, you may eventually decide to invest outside of syndicates and source deals independently. However, for those just starting out, joining a reputable syndicate can be an excellent way to learn the ropes and build your portfolio.

Once you've identified promising startup opportunities, either through a syndicate or independently, the next step is to deploy your capital. This typically involves completing the necessary paperwork, such as subscription agreements and accredited investor certifications, and transferring funds to the startup or investment vehicle.

It's important to remember that angel investing is a long-term endeavor, and it may take several years before you see any returns from your investments. During this holding period, it's crucial to track the performance of your portfolio companies, stay informed about their progress, and potentially provide guidance or support where appropriate.

Some investors take a more hands-on approach, serving as advisors or mentors to the startups they've invested in, while others prefer a more passive role. The level of involvement is a personal choice, but staying engaged and informed can help you make better decisions about follow-on investments or potential exit opportunities.

In summary, selecting startups and deploying capital involves leveraging resources like angel investor syndicates, conducting thorough due diligence, and being selective in your investment decisions. Once you've made your investments, it's important to track their performance, stay engaged, and be prepared for the long-term nature of angel investing.